You’ve created your product, built your marketing campaigns and have interested buyers ready. But unfortunately, your customer onboarding process isn’t performing well and you’re not getting new customers. The process might be slow and complex or maybe it’s too invasive — whatever the reason, your online business can’t grow without effective customer onboarding.

In fact, a Trulioo commissioned Consumer Account Opening Report revealed that 73% of people consider the account opening process to be a “make or break” point in their future relationship with a brand.

The online sign-up process might seem simple (after all, it’s just a form, right?) the choices a business makes regarding the selection and implementation of digital identity verification solutions are often the difference between success and failure. Delivering a quick and seamless onboarding process gives the customer a frictionless experience that increases confidence and trust while also building your reputation.

Customer onboarding and KYC

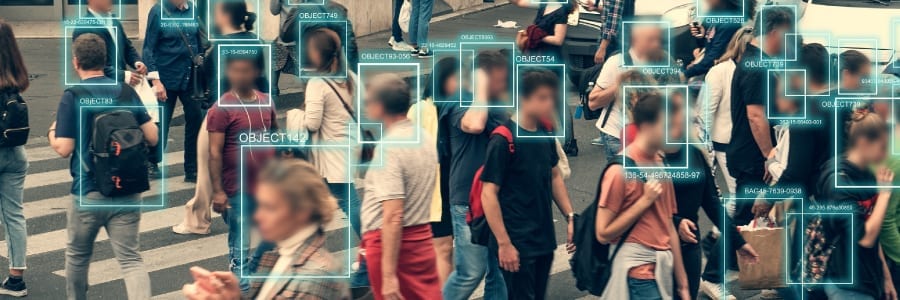

For many organizations, performing Know Your Customer (KYC) procedures on new accounts is mandatory. While KYC is not a legal requirement for every business, it’s still a powerful fraud prevention and trust and safety measure to verify customers’ identities. You want to know who you’re doing business with and the potential risk they pose.

Sadly, if not carefully considered and optimized, KYC can lead to an onboarding experience that is slow and cumbersome. And this often results in customer abandonment; the Consume Account Opening Report found that almost three-quarters (73%) of consumers claim that they are increasingly intolerant of poor experiences when opening new online accounts, and will switch to other businesses/service providers if they encounter a sub-optimal process.

So, how can an organization balance the needs for security and speed when onboarding?

One answer is to use a risk-based approach; customers, business lines, markets and transaction amounts all vary, so handling all new clients the same way is not ideal. Understanding the different risk levels customers pose and adapting the onboarding requirements to fit specific scenarios provides a more nuanced approach and better results.

Consider document verification. Demonstrating possession of an ID document does demonstrate a certain level of identity verification. As a report from One World Identity found:

where friction is met in the digital onboarding process requiring presentation of identity documentation (scanning and emailing copies, mailing paper copies, or having to provide original copies in person), 25% of applicants will abandon the process and go elsewhere.

This isn’t suggesting that document verification isn’t valid. However, you need to consider which situations it makes sense and where in the customer journey it should take place.

Having multiple options to verify customers and optimizing workflows to fit specific needs delivers the most straightforward path to excellent onboarding results. Through deep data analysis, verification intelligence and onboarding expertise, workflows can be honed and modified to maximize conversions and enhance ROI.

Improving the customer experience

Every little step you can take to make it easier and quicker for the customer while maintaining security and compliance is worth it. Some measures include:

Minimizing data collection

Carefully consider if you need every question you’re currently asking. The more information you ask for, the longer the form and the less likely the customer will stick around. There’s also the issue of how you handle the data and complex data privacy laws; the more data you collect, the more risk you face.

Also, consider when you request the information. Do you need all that information right at the start, or can you delay specific data requests for later in the customer journey?

Reducing onboarding time

Do you know how long it takes to complete your sign-up? What about if the customer is using an older phone or has a slower internet connection?

Go through the process yourself. Or, better yet, test various users and watch what they do (or don’t do). You can use multiple software applications to track engagement and activities and use all this information to make better forms.

You can also run A/B tests or do multivariate testing to see what combination of factors works best.

Setting and measuring benchmarks

It’s not enough to run through your optimization once and be done with it. Instead, you need to monitor it and track the performance. If your offering, audience or technology changes, this will impact the results first experienced at initial setup. Note your various performance metrics such as form-fill, abandonment and conversion rates.

Not only can you monitor what customers do, but you can also monitor and optimize back-end processes. What are your match rates on identity checks? What are the acceptance and chargeback rates for your payments?

Optimizing the experience for different audiences and markets

It’s essential to understand each market you operate in and customize solutions based on local requirements. What works for one market or product won’t necessarily work for another. Different audiences have diverse expectations and beliefs, everything from how they pay to what information they’re comfortable providing.

Ensuring (and demonstrating) safety and security

A Trulioo report, New fraud threats in the digital-first world, found that 71% of people cite security as the most important consideration when opening a new account.

Consumers wary of doing business with an online service due to security or privacy concerns impact potential revenue. All the efforts to acquire a customer will be for nothing if the consumer abandons the sign-up or onboarding process because of a lack of trust.

Organizations need to provide the appropriate trust signals and have robust and secure systems to demonstrate that consumers’ privacy and payment information are safe.

The appropriate customer onboarding service

Perhaps the most crucial decision you need to make when it comes to customer onboarding is which service provider will be able to meet your present and future needs.

Which service can adapt and provide various types and layers of verification data? Which service can offer solutions in all the markets that you want to operate in? Which service has the scale and technology to deliver to your customers, wherever they’re located? Which service can provide the expertise and support to optimize results, no matter what business or market you’re in?

Your organization has spent a lot of time and effort to get in front of the customer. Making sure that the last step, that online point of sale, works effectively is critical.

Solutions

Customer Onboarding

Achieve Agile Customer Verification Around the World

Featured Blog Posts

Business Verification (KYB)

Enhanced Due Diligence Procedures for High-Risk CustomersIdentity Verification

Proof of Address — Quickly and Accurately Verify AddressesBusiness Verification (KYB)

How to Verify Legitimate Businesses and Merchants