France’s effort to improve its digital economy is making it a hot market for organizations looking to expand globally. The France Num initiative is at the heart of that effort with a focus on improving connectivity, expanding education and digitalizing French companies.

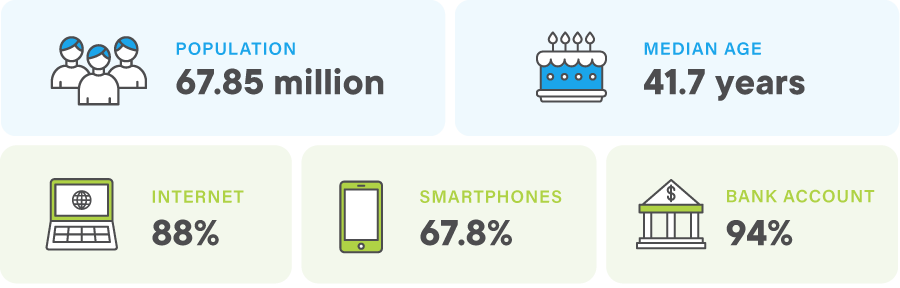

The country, with the world’s seventh-largest economy and a population of 67.8 million, has the infrastructure and openness to investment that could make it an important market for strategic positioning in the EU.

But expansion carries with it a need to understand that country’s requirements around Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations and to ensure your company’s identity verification, Customer Due Diligence and risk management processes can comply.

France AML regulations

The Autorité des marchés financiers (AMF) is France’s main financial regulator. Others of note are the Autorité de contrôle prudentiel et de résolution (ACPR), which supervises banking and insurance and ensures financial system stability, and Traitement du renseignement et action contre les circuits financiers clandestins (TRACFIN), which processes financial intelligence.

France takes a risk-based approach to combat money laundering. AMF’s guidance suggests “adapting the measures taken to the level of risk of money laundering and terrorist financing and by optimizing the resources allocated.”

AMF specifies some scenarios, such as public or government entities, as low risk and others, such as Politically Exposed Persons or accounts from countries on the Financial Action Task Force’s black list, as high risk. But organizations must determine most risk measurements and classifications.

Companies can help assess and counter risk by examining the joint guidelines on risk factors and simplified and enhanced customer due diligence. Those factors include product, country and client risks.

Understanding the risk requires effectively identifying the customer and collecting enough accurate information about the business relationship.

KYC requirements in France

France has specified identity information organizations must collect and keep up to date for compliance:

- For a person — name, birthdate and place of birth

- For an organization — name, registration number and address of registered office or operations

There are several legally acceptable remote options for verifying a person:

- Using electronic Identification, Authentication and Trust Services (eIDAS) certificates or an ID

- Using the National Information Systems Security Agency standard for Remote Identity Verification Service Providers (PVID)

A certified copy of the business registration document directly from the registries is acceptable for remote business verification. In France, all new businesses must register with the Centre des Formalités des Entreprises (CFE), which is the business registration center, to receive the appropriate business registration number.

Performing identity verification in France

Privacy is paramount in France, whether through the General Data Protection Regulation or the country’s culture. People are generally reluctant to share personal information, so collecting confidential data can be challenging in the market. France also does not have a credit-scoring system, so identity verification has been difficult.

One verification method gaining momentum is through mobile network operator data and one-time passwords. That method requires explicit consent.

As for digital identity systems, the PVID standard is new, and certification is just beginning. While eIDAS has been around for longer, its uptake has been slow.

But new initiatives using an updated French national eID card that is eIDAS compatible will let people complete online transactions using their phones. The system integrates with the FranceConnect platform, which allows digital access to government services and already has more than 28 million users and 900 service providers.

A holistic approach to gathering identity verification data can streamline the process in France. Using multiple data types and sources can provide strong coverage in a difficult-to-access market. Advanced address matching technology can deliver higher match rates than traditional results.

Technology that adds to its verification capabilities as new sources and channels become available can help maximize success in France’s growing digital economy.

Solutions

Individual Verification

Simplify KYC Identity Verification Across the Globe

Resources Library

Know Your Customer

White Papers

Build Trust and Safety With Digital KYC

Featured Blog Posts

Business Verification (KYB)

Enhanced Due Diligence Procedures for High-Risk CustomersIdentity Verification

Proof of Address — Quickly and Accurately Verify AddressesBusiness Verification (KYB)

How to Verify Legitimate Businesses and Merchants